Payroll online calculator 2023

Find The Right System To Manage And Support Your Employees From Hire To Retire. Well calculate the difference on what you owe and what youve paid.

Between Dates Income Calculator Gross Wages And Work Stats

Ad Compare This Years Top 5 Free Payroll Software.

. Employers and employees can use this calculator to work out how much PAYE. Updated for April 2022. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to.

The payroll tax rate reverted to 545 on 1 July 2022. Taxes Paid Filed - 100 Guarantee. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. See where that hard-earned money goes - with UK income tax National Insurance student. We Can Help You Make The Right Decision.

Its so easy to. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Ad Launch your own payroll PEO product and increase your ARR by 4235.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Expected DA January 2022. Free Unbiased Reviews Top Picks.

Deductions from salary and wages. SARS eFiling Tax Practitioner Auto-assessment New to tax SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay INCOME Which. Gray Typical Non-working Days.

Red Federal Holidays and Sundays. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Payroll Doesnt Have to Be a Hassle Anymore.

Ad Process Payroll Faster Easier With ADP Payroll. Taxes Paid Filed - 100 Guarantee. AFD CSD Price 2022.

The maximum an employee will pay in 2022 is 911400. Form TD1-IN Determination of Exemption of an Indians Employment Income. Get Started With ADP Payroll.

Start Afresh in 2022. Expected DA July 2021. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Local holidays are not listed. Thats where our paycheck calculator comes in. Increase revenue generation with our embedded payroll product.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. It will confirm the deductions you include on your. The Salary Calculator has been updated with the latest tax rates which.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Return filed in 2023 2021 return filed in 2022. Sign up for a free Taxpert account and e-file your returns each year they are due.

See your tax refund estimate. The UK Salary Calculator determines your AnnualMonthlyHourly Take-Home Pay by estimating your Income Tax National Insurance Student Loan and Pension. 7th CPC Pay Calculator.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Ad So Many Payroll Systems So Little Time. Get Started With ADP Payroll.

On the other hand if you make more than 200000 annually you will pay. Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. If youve already paid more than what you will owe in taxes youll likely receive a refund.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Payroll So Easy You Can Set It Up Run It Yourself. Multiply taxable gross wages by the number of pay periods per.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Compare This Years Top 5 Free Payroll Software. Find Easy-to-Use Online Payroll Companies Now.

No Need to Transfer Your Old Payroll Data into the New Year. Use our PAYE calculator to work out salary and wage deductions. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which.

Get a head start on your next return. Sage Income Tax Calculator. Ad Process Payroll Faster Easier With ADP Payroll.

Ad Plus 3 Free Months of Payroll Processing. Begin tax planning using the 2023 Return Calculator below. Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution Ani Globe.

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. The Salary Calculator - 2022 2023 Tax Calculator Welcome to the Salary Calculator - UK New.

Business Days Calculator Calculate Working Days In A Year

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

How To Calculate Net Operating Loss A Step By Step Guide

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Knowledge Bureau World Class Financial Education

Grade Book Templates 13 Free Printable Doc Pdf Xlx Grade Book Grade Book Template Templates

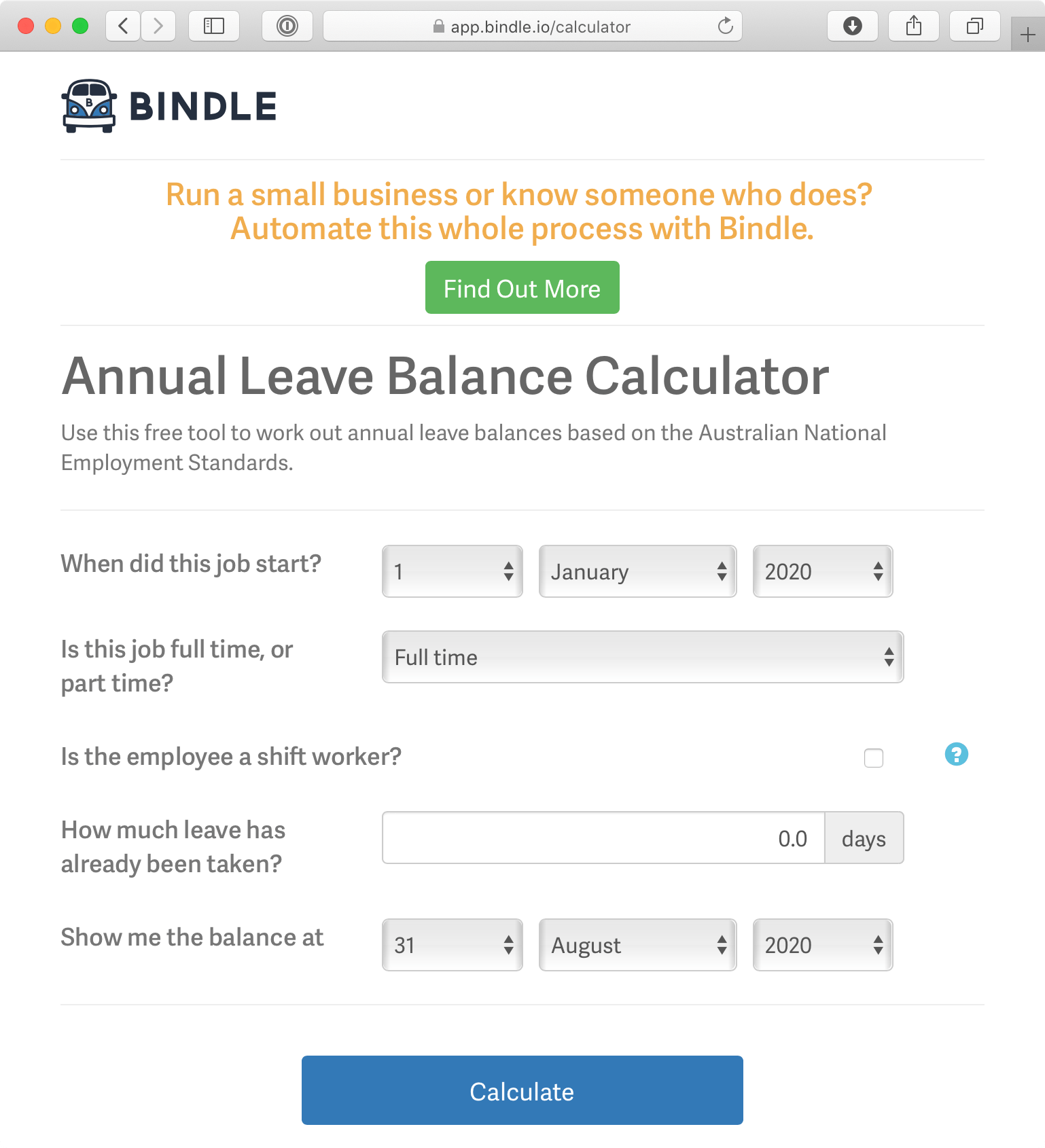

Free Australian Annual Leave Calculator Bindle Annual Leave Tracking Software

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

Sharing My Tax Calculator For Ph R Phinvest

2021 2022 Income Tax Calculator Canada Wowa Ca

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Manitoba Income Tax Calculator Wowa Ca

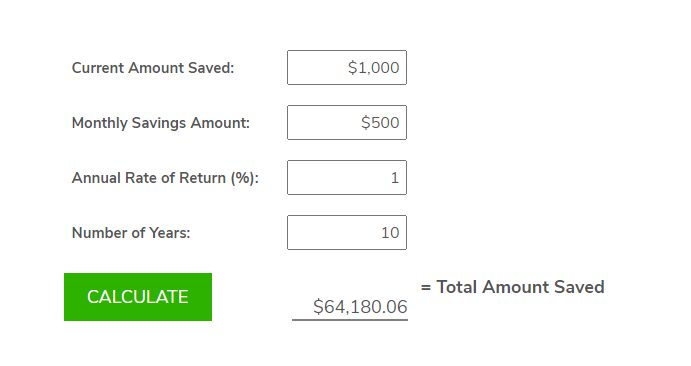

Free Simple Savings Calculator Investinganswers